The assessment of service quality in the health insurance sector focuses on evaluating customer satisfaction and operational efficiency. This study examines key factors affecting service delivery and client experiences.

The health insurance sector plays a vital role in ensuring access to medical care. Quality of service significantly impacts customer satisfaction and loyalty. As competition intensifies, understanding service quality becomes essential for insurers. This study analyzes various dimensions, such as responsiveness, reliability, and empathy.

By assessing these factors, insurers can identify areas for improvement. Enhanced service quality leads to better patient outcomes and increased trust. This research aims to provide actionable insights for health insurance providers, helping them to meet customer expectations effectively. Ultimately, a focus on service quality can transform the health insurance landscape for the better.

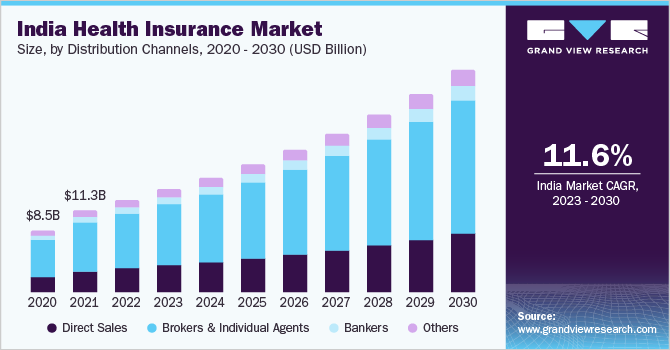

Credit: www.grandviewresearch.com

The Importance Of Service Quality In Health Insurance

Service quality plays a crucial role in the health insurance sector. It directly affects customer experiences and perceptions. High service quality leads to satisfied customers. Satisfied customers are more likely to stay loyal to their providers. Understanding this importance helps companies improve their services.

Impact On Customer Satisfaction

Customer satisfaction is vital for any business. In health insurance, it can dictate success. High service quality leads to:

- Trust: Customers feel secure with reliable service.

- Engagement: Satisfied customers are more involved.

- Positive Feedback: Happy customers share their experiences.

Insurance companies can assess customer satisfaction through surveys and feedback. Here are some key factors influencing satisfaction:

| Factor | Impact on Satisfaction |

|---|---|

| Response Time | Quick responses boost satisfaction. |

| Claim Processing | Efficient claims lead to happier customers. |

| Customer Support | Friendly support increases trust. |

Influence On Policy Renewal Rates

Service quality significantly affects policy renewal rates. Customers with positive experiences are more likely to renew. Key reasons include:

- Consistency: Reliable service encourages renewals.

- Value for Money: Customers expect quality for their payments.

- Personalization: Tailored services increase customer loyalty.

Companies can improve renewal rates by focusing on service quality. Tracking customer interactions helps identify areas for improvement. Enhanced service leads to higher retention. This ultimately boosts profits.

Measuring Service Quality: Traditional Methods

Assessing service quality in the health insurance sector is crucial. Traditional methods offer reliable ways to gather insights. They help organizations understand customer satisfaction and improve services.

Surveys And Questionnaires

Surveys and questionnaires are common tools for measuring service quality. They collect data from a large number of participants. This method is efficient and cost-effective.

- Closed-ended questions: Easy to analyze.

- Open-ended questions: Provide detailed feedback.

- Rating scales: Allow respondents to express satisfaction levels.

Surveys can be conducted online or in-person. Online surveys reach more people quickly. In-person surveys offer personal interaction.

| Survey Type | Advantages | Disadvantages |

|---|---|---|

| Online Surveys | Wide reach, quick results | Limited to internet users |

| In-person Surveys | Personal touch, higher response rate | Time-consuming, costly |

Focus Groups And Interviews

Focus groups and interviews provide deeper insights into service quality. They involve small groups of participants discussing their experiences. This method captures emotions and attitudes.

- Focus Groups: Group discussions guided by a facilitator.

- Interviews: One-on-one conversations for detailed feedback.

Focus groups generate diverse opinions. Interviews allow for personal stories and experiences. Both methods reveal common themes in customer service.

- Identify key participants.

- Prepare discussion guides or questions.

- Conduct sessions in a comfortable setting.

- Analyze responses for trends.

Using traditional methods helps organizations enhance service quality. Understanding customer needs leads to better health insurance offerings.

Innovative Approaches To Service Assessment

Assessing service quality in the health insurance sector is crucial. Innovative approaches improve customer satisfaction. These methods focus on real-time data and advanced analytics. They help insurers understand client needs better.

Real-time Feedback Mechanisms

Real-time feedback mechanisms allow instant input from clients. They help insurers gauge service quality quickly. Here are some effective methods:

- Mobile Apps: Customers can rate services immediately.

- Chatbots: Automated responses gather feedback 24/7.

- SMS Surveys: Quick polls after service use.

These tools provide immediate insights. Insurers can adjust services rapidly based on feedback.

Utilizing Big Data Analytics

Big data analytics transforms service assessment. It analyzes vast amounts of data to find patterns. This approach offers several advantages:

- Customer Segmentation: Understand different client needs.

- Predictive Analysis: Anticipate future service demands.

- Performance Tracking: Measure service effectiveness over time.

With these insights, insurers can enhance service quality. Data-driven decisions lead to better customer experiences.

Key Dimensions Of Service Quality In Health Insurance

Understanding the key dimensions of service quality is essential in the health insurance sector. These dimensions help evaluate how well a service meets customer needs. They include tangibles, reliability, responsiveness, assurance, and empathy. This section will focus on two critical dimensions: tangibles and reliability.

Tangibles: The Physical Evidence

Tangibles refer to the physical aspects of a service. This includes facilities, equipment, and materials. Customers assess these elements to judge service quality. Here are some important factors:

- Cleanliness: Well-maintained offices create trust.

- Modern Equipment: Up-to-date tools enhance service perception.

- Informative Materials: Brochures and documents should be clear.

Providing high-quality tangibles can greatly influence customer satisfaction. A clean and welcoming environment promotes a positive experience.

Reliability: Consistency Of Service Performance

Reliability is about delivering promised services consistently. It is crucial for building customer trust. Here are key aspects of reliability:

- Timeliness: Services should be provided on time.

- Accuracy: Information given must be correct and clear.

- Dependability: Customers expect consistent service quality.

Reliable services lead to customer loyalty. Customers feel valued when services meet their expectations.

| Dimension | Importance |

|---|---|

| Tangibles | Influences initial impressions and trust. |

| Reliability | Builds loyalty and long-term relationships. |

Customer Expectations Vs. Perceptions

Understanding the gap between customer expectations and perceptions is crucial in health insurance. Customers expect reliable service, quick responses, and clear information. However, their actual experiences often differ. This mismatch can lead to dissatisfaction and distrust.

Identifying Gaps In Service Delivery

Identifying gaps helps improve service quality. Here are key areas to focus on:

- Response Time: Customers expect quick answers.

- Clarity of Information: Complex terms confuse customers.

- Accessibility: Customers want easy access to services.

Use surveys to gather feedback. Analyze data to find common issues. This will reveal where expectations do not match perceptions.

Strategies To Align Services With Expectations

Aligning services with customer expectations enhances satisfaction. Here are effective strategies:

- Training Staff: Equip employees with communication skills.

- Clear Communication: Use simple language in all materials.

- Regular Feedback: Conduct surveys to assess customer needs.

- Improving Response Times: Streamline processes for quicker service.

Implementing these strategies can bridge the gap. Happy customers lead to a better reputation and increased loyalty.

Credit: www.researchgate.net

The Role Of Technology In Service Enhancement

Technology plays a crucial role in improving service quality in the health insurance sector. It streamlines processes and enhances customer experience. With the right tools, insurance providers can offer faster, more reliable services. This leads to greater customer satisfaction and loyalty.

Automated Claim Processing

Automated claim processing is a game-changer in health insurance. It reduces human error and speeds up the claims journey. Here are some key benefits:

- Speed: Claims are processed in minutes, not days.

- Accuracy: Reduces errors that cause claim denials.

- Transparency: Customers can track their claims easily.

Implementing automated systems saves time and resources. Insurance companies can focus on more complex issues. This boosts overall service quality and satisfaction.

Online Customer Portals And Support

Online customer portals offer a direct line to services. They empower customers to manage their policies easily. Key features include:

| Feature | Description |

|---|---|

| 24/7 Access | Customers can check their information anytime. |

| Easy Claims Submission | Submit claims with just a few clicks. |

| Live Chat Support | Get immediate help from customer service. |

These portals improve communication and reduce wait times. Customers feel more in control of their health insurance. Technology enhances the overall experience and builds trust.

Regulatory Impact On Service Quality

The regulatory environment significantly influences service quality in the health insurance sector. Regulations ensure that insurance providers uphold standards. This leads to better patient care and trust in the system. Key regulations like HIPAA and the ACA play crucial roles.

Compliance With Health Insurance Portability And Accountability Act (hipaa)

HIPAA sets the standard for protecting sensitive patient information. Compliance is crucial for health insurance providers. It promotes trust and ensures confidentiality.

- Privacy Rules: Protect patient information from unauthorized access.

- Security Rules: Safeguard electronic health records.

- Transaction Standards: Ensure efficient electronic transactions.

Failing to comply can lead to penalties. This impacts service quality negatively. Insurers must invest in training and technology to meet these standards.

The Affordable Care Act (aca) And Service Standards

The ACA introduced reforms to improve service quality in health insurance. It emphasizes accessibility and affordability.

| ACA Component | Impact on Service Quality |

|---|---|

| Essential Health Benefits | Standardizes coverage for critical services. |

| Preventive Services | Encourages routine care without out-of-pocket costs. |

| Consumer Protections | Prevents discrimination based on pre-existing conditions. |

These components enhance the quality of care for patients. Insurers must adapt to these changes to remain competitive.

Future Trends In Health Insurance Service Quality

The health insurance sector is evolving rapidly. New technologies and consumer expectations are driving changes. Understanding these trends is vital for providers. They can enhance service quality and customer satisfaction.

Predictive Analytics For Personalized Service

Predictive analytics is changing how health insurance companies operate. It analyzes data to forecast future trends. This technology can:

- Identify at-risk patients.

- Offer tailored health plans.

- Improve customer engagement.

Companies can use this data to create personalized experiences. Customers receive services that suit their unique needs. This builds trust and loyalty.

| Predictive Analytics Benefits | Impact on Service Quality |

|---|---|

| Improved Risk Assessment | Better coverage options |

| Enhanced Customer Insights | Customized communication |

| Efficient Resource Allocation | Faster service delivery |

The Rise Of Telemedicine And Its Service Implications

Telemedicine is reshaping health insurance service quality. It allows patients to connect with doctors remotely. This trend provides several benefits:

- Increased access to healthcare.

- Lower costs for patients.

- Convenience in scheduling appointments.

Insurers must adapt to these changes. They need to include telehealth services in their plans. This ensures customers receive comprehensive care. It also enhances the overall service experience.

As telemedicine grows, so do expectations. Customers want seamless integration with their insurance plans. They expect quick responses and reliable support.

Case Studies: Success Stories And Lessons Learned

Examining real-life examples reveals effective strategies in the health insurance sector. These case studies highlight how companies improved their service quality. They showcase innovations and solutions to common challenges. Learning from these successes can inspire other organizations.

Innovations In Customer Service

Innovations play a key role in enhancing customer service in health insurance. Here are some notable examples:

- Telemedicine Services: Many insurers adopted telemedicine. This made consultations easier and faster for patients.

- Mobile Apps: Companies developed apps for easy access. Users can check claims, find doctors, and manage policies.

- AI Chatbots: AI chatbots answer queries 24/7. They provide instant support and improve customer satisfaction.

These innovations have led to higher customer retention rates. They also enhance the overall experience for clients.

Overcoming Challenges In Service Delivery

Health insurance companies face several challenges in service delivery. Successful case studies show how to tackle these issues:

- Streamlining Processes: Organizations simplified their claims processes. This reduced processing time significantly.

- Staff Training: Continuous training improved employee skills. Well-trained staff can better assist customers.

- Feedback Mechanisms: Companies implemented feedback systems. Listening to customers helps address their concerns effectively.

These strategies lead to improved service delivery. They create a more positive customer experience and build trust.

| Company Name | Innovation Implemented | Outcome |

|---|---|---|

| HealthCo | Telemedicine | Increased consultations by 50% |

| InsureRight | Mobile App | Improved user satisfaction by 40% |

| CarePlus | AI Chatbot | Reduced response time by 70% |

These success stories serve as valuable lessons. They highlight the importance of innovation and adaptability in the health insurance sector.

Credit: www.infotech.com

Frequently Asked Questions

What Factors Affect Service Quality In Health Insurance?

Service quality in health insurance is influenced by several factors. These include customer service responsiveness, claims processing efficiency, and the clarity of policy information. Additionally, the accessibility of healthcare providers plays a significant role. Understanding these factors helps consumers make informed choices about their insurance plans.

How Can Service Quality Be Measured In Health Insurance?

Service quality in health insurance can be measured through surveys and feedback mechanisms. Tools like Net Promoter Score (NPS) and Customer Satisfaction Score (CSAT) gauge client satisfaction. Analyzing claim resolution times and service accessibility also provides insights. Regular assessments ensure continuous improvement in service delivery.

Why Is Service Quality Important In Health Insurance?

Service quality is crucial in health insurance as it impacts customer trust and satisfaction. High-quality service leads to better customer retention and loyalty. It also ensures that clients receive timely support during critical health moments. Ultimately, quality service enhances the overall experience of policyholders.

What Are Common Service Quality Issues In Health Insurance?

Common service quality issues in health insurance include delayed claims processing and poor customer support. Miscommunication about policy details often leads to customer frustration. Additionally, lack of transparency regarding coverage options can cause confusion. Addressing these issues is vital for improving client satisfaction.

Conclusion

Evaluating service quality in the health insurance sector is essential for enhancing customer satisfaction. This study highlights critical areas for improvement. By focusing on quality, insurers can build trust and foster loyalty. Prioritizing service excellence will ultimately lead to better health outcomes and a more robust insurance industry.

Leave a Comment